The Payroll Blog

Choosing to make your health a priority in the new year is a popular resolution for many. However, health can take on various forms that you may not be factoring into your resolutions.

- Home

- Resources

- Payroll Blog

- How Much Federal Tax is Taken Out of my Paycheck

How Much Federal Tax is Taken Out of my Paycheck (2018)

Income taxes are top of mind right now, as we've all completed (or, are hopefully close to completing) the task of filing our returns to the IRS.

With 2018 coming to a close, our thoughts naturally turn to….tax season. We kid, but within the next 2 months you’ll be distributing W2s to your employees and possibly collecting one yourself, depending on how your business is structured.

In a perfect world, you would never have to pay taxes on the money you earn and every dollar would end up in your bank account. The unfortunate reality is that a variety of federal, state, and possibly even local taxes are deducted from your, and your employee’s, paycheck.

While understanding the tax requirements for your state and any local jurisdictions is critical to correctly calculating payroll and paying and filing the associated taxes, these requirements vary greatly by geography. Due to that specificity and the fact that, for most, federal taxes account for the greatest portion of payroll taxes, we are going to focus on the federal payroll taxes you should expect to see on your paystub and W2.

What Do We Mean by Federal Tax?

We’ve broken down what the federal payroll taxes are, and who is responsible for paying them, in a previous post. For the purposes of this post, we are going to look at what you should expect for all the employee-side federal payroll taxes, in terms of rates and factors that might affect your final pay amounts. We’ll evaluate how the following taxes are calculated:

Note: We will not be covering Federal Unemployment Tax Act (FUTA) taxes in this post, as these are solely paid by the employer and not the employee.

What is the percentage of federal taxes taken out of my paycheck?

FIT

While you may be under the impression that federal income tax is a relatively simple calculation based on your wages paid and the tax rate, it is slightly more complicated in practice.

There are multiple factors that are used to determine your federal income tax rate and subsequent take-home pay, including:

- Number of withholding allowances

- Filing status

- Amount of money earned during the pay period

- Retirement account contributions

Pro tip: It’s best practice to have a current Form W4 on file with your employer, as this is the declaration used to assess your withholding allowances and inform your FIT rate. These can vary year to year if you have a life event, for example. In addition to completing a W4 upon being hired, we recommend that you revisit your responses each year—December is a great time to do so as you prepare to enter the new year.

We break down the current W4 here.

Withholding Allowances

Having an accurate W4 on record is critical because this documents how many allowances you should claim. Your number of allowances is determined by your filing status, whether or not you have dependents, and the number of jobs you have.

As a general rule of thumb, the fewer allowances you claim, the more your employer will withhold in federal income tax from your paycheck—which may result in a refund. Conversely, the more allowances you claim the higher your take home pay.

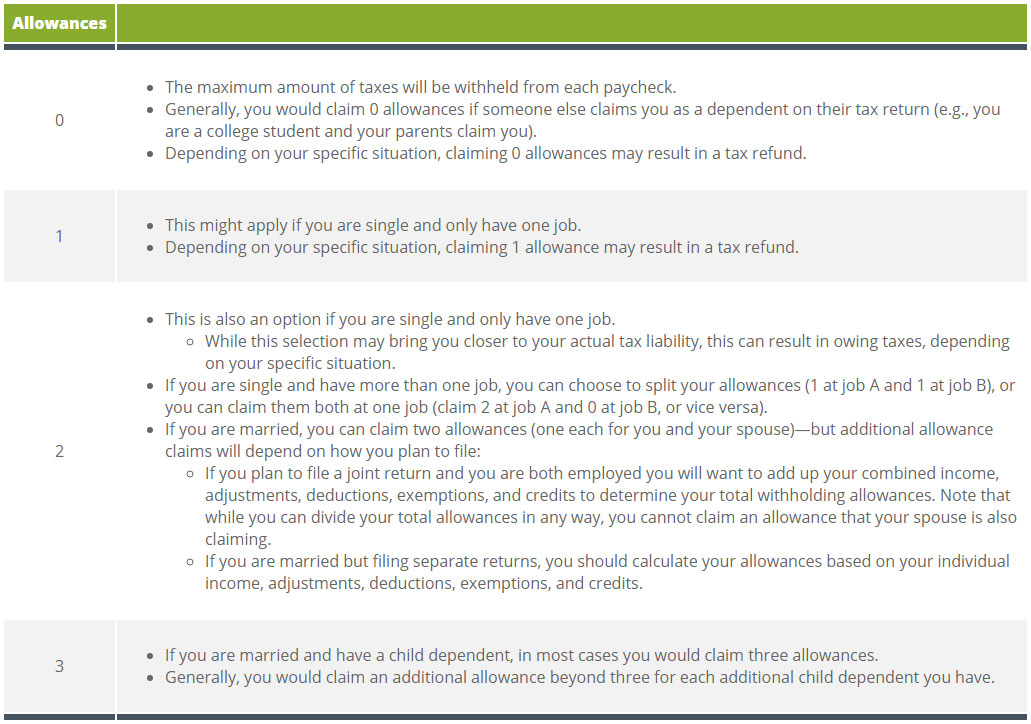

Some suggested guidelines for the number of allowances you should claim follow—but for questions related to your specific tax situation, you should consult your accountant or tax professional.

Filing Status

When it comes time to file a tax return, you can have one and only one filing status. The filing status you use is largely dependent on one question:

Were you considered married on the last day of the year?

If the answer is yes, you are considered married for tax filing for that year—if no, you are considered not married for that year.

Note: There are special circumstances under which married persons may be viewed as not married, for example if they are qualifying for Head of Household status even if not legally separated or divorced.

- Single Filing Status: to be used by people who are considered unmarried on the last day of the year. If you are single and claiming a dependent, you may be eligible for Head of Household filing status.

- Head of Household Filing Status: If you are unmarried, paid more than half the costs of keeping up a home, and have a Qualifying Person, you may qualify for Head of Household filing status. This filing status provides a higher standard deduction and lower tax rate than the Single filing status. Qualifying for Head of Household requires meeting strict criteria; only certain closely-related dependents will qualify a filer for Head of Household. There are certain circumstances under which a married person may also qualify for Head of Household, for example if they are claiming a qualifying dependent and have been living separate from their spouse for the final six months of the year or longer.

- Qualifying Widow/Widower with Dependent Child Filing Status: If you are unmarried because your spouse died within the year, you may still file jointly or separately as a married person for that year, regardless of whether you have a dependent. Following the initial year of death, if you remain unmarried and have a dependent child, you can file under the Qualifying Widow/Widower with Dependent Child filing status; this allows you to continue benefiting from the same standard deduction and the same federal tax rates as for married couples filing jointly. This status can be claimed for a total of two years after which, if you remain unmarried, your filing status will need to change to Single or Head of Household, depending on whether you still claim a child dependent. If you remarry following the two year Qualifying Widow/Widower with Dependent Child Filing Status eligibility period, you should file using one of the married filing statuses.

- Married Filing Jointly Status: As a married person, you may choose to file jointly with or separately from your spouse. A joint tax return combines the incomes and deductions of both spouses. In order to file jointly, both spouses must agree to file a joint return, and both must sign the return prior to filing. Married Filing Jointly offers more federal tax benefits than Married Filing Separately, though there are reasons you might choose the latter over the former.

- Married Filing Separately Status: Married Filing Separately filers receive the least tax benefit, but realize separate tax liabilities. It is important to consult an accountant or tax professional to determine which married filing status will provide the best benefit for your specific financial situation. Some reasons a couple may choose to file separately include:

- Only one spouse wants to file taxes.

- One spouse suspects that the information on the joint return might not be correct.

- One spouse doesn't want to be liable for the payment of tax due on the joint return.

- One spouse owes taxes, and the other is due a refund.

- The spouses are separated, but not yet divorced, and want to keep their finances separate.

Consult IRS Publication 501 for additional information on filing status.

Amount of Money Earned During the Pay Period

The amount of money you earn during your pay period, when viewed with your filing status, determines your income bracket and associated federal income tax rate. To view the 2018 income brackets, download our Small Business Tax Guide.

Retirement Account Contributions

Your taxes may also be impacted if you contribute a portion of your paycheck to a tax-advantaged retirement savings account. Eligible plan types include traditional IRAs and 401(k)s. Contributions to these plans are considered pre-tax, and are therefore exempt from federal income tax during the year in which you make the contribution.

These contributions reduce your income tax burden for the current year. So, for example if you were in the 24% federal income tax bracket and made a $12,000 pre-tax contribution to your 401(k), you would not have to pay taxes on the $12,000.

There are limits to the pre-tax contribution amounts, however. For 2018, you can make a tax-deductible contribution of up to $18,500 toward your 401(k), and up to $5,500 toward a traditional IRA.

If you are aged 50 or older, you are eligible to make additional “catch-up” retirement contributions.

FICA

Commonly referred to as “the payroll tax,” though not inclusive of all related payroll taxes, FICA refers to tax contributions paid by both the employee and employer toward Social Security and Medicare.

Here’s what you need to know for FICA in 2018:

- The Social Security tax rate is 6.2% of all earned income up to $128,400.

- The Medicare tax rate is 1.45% of all earned income on the first $200,000 in wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return) and an additional 2.35% Medicare tax (1.45% base tax plus .9% surtax) on wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

- Both the employer and employee pay FICA.

Figure it out with an online payroll calculator

The IRS offers a withholding calculator that employees and employers can use to do a quick checkup of their withholding amounts to ensure the correct amount is being withheld each paycheck.

Pro tip: if you're doing your payroll taxes yourself and it's turning into a time suck, let us help you out. Get a free quote on how much it would cost to hand over the task of doing your payroll, including guaranteed tax filing, right here.

Ready to give it a try?

Join the thousands of small businesses and households that trust SurePayroll for fast, easy and accurate payroll processing - for free!

Not sure what you need?

Contact us to figure it out!

Call 855-354-6941